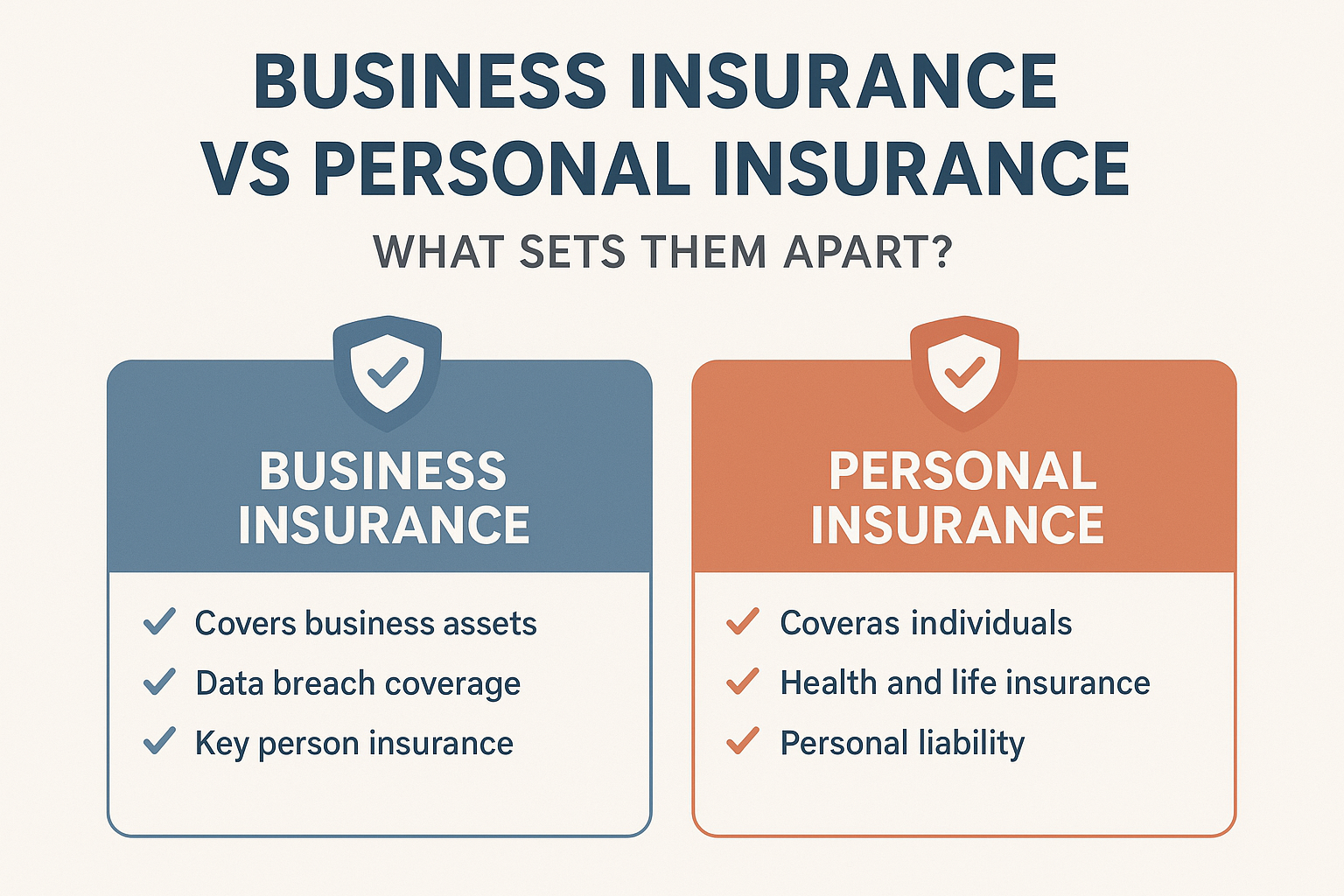

In today’s unpredictable world, insurance is no longer optional—it’s a necessity. Whether you’re running a company or protecting your family, the right insurance coverage ensures financial security and peace of mind. But here’s a common question many people ask: What’s the difference between business insurance and personal insurance?

While both types of coverage share the same foundation—protecting you from financial risks—they serve different purposes, audiences, and liabilities. In this article, we’ll break down the key differences between business insurance and personal insurance, explore why each matters, and help you determine which coverage is right for you.

What Is Business Insurance?

Business insurance is designed to protect companies, entrepreneurs, and professionals against risks related to their operations. From lawsuits to property damage to employee injuries, it ensures that your business can survive unexpected setbacks.

Key Features of Business Insurance:

- Covers property damage (buildings, equipment, inventory).

- Provides liability protection against lawsuits.

- Includes workers’ compensation insurance for employee injuries.

- Protects against business interruption due to disasters.

- Can include professional liability insurance for service providers.

What Is Personal Insurance?

Personal insurance is designed for individuals and families. It covers risks related to personal life—such as health, property, vehicles, and life. Unlike business insurance, which protects a company’s assets and operations, personal insurance ensures financial stability in your personal life.

Key Features of Personal Insurance:

- Covers life insurance and health insurance.

- Protects personal property like homes, cars, and valuables.

- Provides auto liability insurance for accidents.

- Includes personal liability coverage for accidents in daily life.

- Often includes travel insurance and other optional protections.

Business Insurance vs Personal Insurance: The Core Differences

| Feature | Business Insurance | Personal Insurance |

|---|---|---|

| Purpose | Protects businesses, employees, and commercial assets | Protects individuals, families, and personal assets |

| Coverage Type | Property, liability, workers’ comp, business income | Life, health, auto, home, travel |

| Liability Coverage | Covers lawsuits from clients, vendors, or employees | Covers personal liability (e.g., car accident) |

| Who Needs It? | Business owners, freelancers, professionals | Individuals, families, property/vehicle owners |

| Premium Costs | Higher (depends on business type & risk level) | Lower (depends on age, lifestyle, assets) |

| Legal Requirement | Often mandatory (workers’ comp, liability insurance) | Often required (auto insurance, health insurance) |

| Policy Customization | Highly customizable depending on industry | Standardized plans with optional add-ons |

Why Do You Need Business Insurance?

Running a business comes with inherent risks. A single accident, lawsuit, or disaster can cripple a company financially. Business insurance ensures that you stay protected.

Common Scenarios Where Business Insurance Helps:

- A customer slips and falls in your store → General liability insurance covers medical bills and lawsuits.

- Your office catches fire → Property insurance pays for rebuilding and lost inventory.

- An employee gets injured on the job → Workers’ compensation covers medical expenses and lost wages.

- A cyberattack compromises client data → Cyber liability insurance helps recover losses and legal costs.

Why Do You Need Personal Insurance?

Personal insurance protects your everyday life and ensures your loved ones remain financially secure. Without it, one medical emergency, accident, or disaster could lead to overwhelming debt.

Common Scenarios Where Personal Insurance Helps:

- A car accident damages your vehicle and injures others → Auto insurance covers repairs and liability.

- A serious illness requires hospitalization → Health insurance pays for treatment costs.

- A house fire destroys your property → Home insurance pays for rebuilding and replacements.

- A family breadwinner passes away unexpectedly → Life insurance provides financial support for dependents.

Cost Comparison: Business vs Personal Insurance

- Business Insurance: Costs vary widely. For small businesses, general liability insurance may cost around $500–$1,200 annually, while comprehensive policies for larger companies can reach tens of thousands per year.

- Personal Insurance: Much cheaper on average. For example:

- Auto insurance → $1,000/year (U.S. average).

- Health insurance → $450/month for individuals.

- Life insurance → Term life starts at $20–$30/month for $500,000 coverage.

Tax Benefits of Business Insurance vs Personal Insurance

Business Insurance Tax Benefits

- Premiums are usually tax-deductible business expenses.

- Helps reduce taxable income while protecting company assets.

Personal Insurance Tax Benefits

- In many countries, premiums for life insurance and health insurance are eligible for tax deductions.

- For example:

- India → Section 80C and 80D allow deductions.

- U.S. → Health savings accounts (HSAs) and certain premiums may be deductible.

Real-Life Examples

- Business Insurance Case Study: Mark owns a small café. A customer slips on a wet floor and sues for medical expenses. Without general liability insurance, Mark would have to pay $50,000 out of pocket. Instead, his business insurance covers the costs, saving him from bankruptcy.

- Personal Insurance Case Study: Lisa, a 35-year-old mother, has family health insurance. When her child requires surgery costing $15,000, her policy covers most expenses, protecting her savings and ensuring timely treatment.

Pros and Cons of Business vs Personal Insurance

Business Insurance Pros

- ✔ Protects against lawsuits & liability

- ✔ Safeguards employees & assets

- ✔ Helps ensure business continuity

Business Insurance Cons

- ✘ More expensive than personal insurance

- ✘ Complex policies that require customization

Personal Insurance Pros

- ✔ Affordable and widely available

- ✔ Protects health, property, and family income

- ✔ Simple and easy to understand

Personal Insurance Cons

- ✘ Limited to personal risks only

- ✘ No coverage for professional or commercial activities

Tips for Choosing the Right Policy

- Assess Your Risk Profile – Businesses face operational risks, while individuals face personal health, property, and income risks.

- Compare Insurance Quotes Online – Use platforms to compare business insurance quotes and personal insurance plans.

- Don’t Underinsure – Choosing the cheapest plan may leave you exposed. Balance affordability with adequate coverage.

- Consider Industry Needs – For businesses, tailor policies to your sector (e.g., professional liability for doctors/lawyers, cyber coverage for IT companies).

- Bundle Policies – Many insurers offer discounts for bundling personal auto + home insurance, or multiple business coverages.

Conclusion: Business Insurance vs Personal Insurance

While both business and personal insurance provide financial protection, they focus on different aspects of life.

- Business Insurance protects companies from lawsuits, accidents, property damage, and employee risks. It’s essential for entrepreneurs, freelancers, and corporations.

- Personal Insurance protects individuals and families from health crises, accidents, property damage, and loss of income due to death.