When it comes to securing your family’s financial future, life insurance is one of the most important investments you can make. However, choosing the right type of life insurance can be confusing—especially when it comes down to term life insurance vs whole life insurance.

Both policies provide valuable protection but serve different purposes. In this comprehensive guide, we’ll break down the differences, benefits, costs, and ideal use cases so you can decide which one is best for your financial goals.

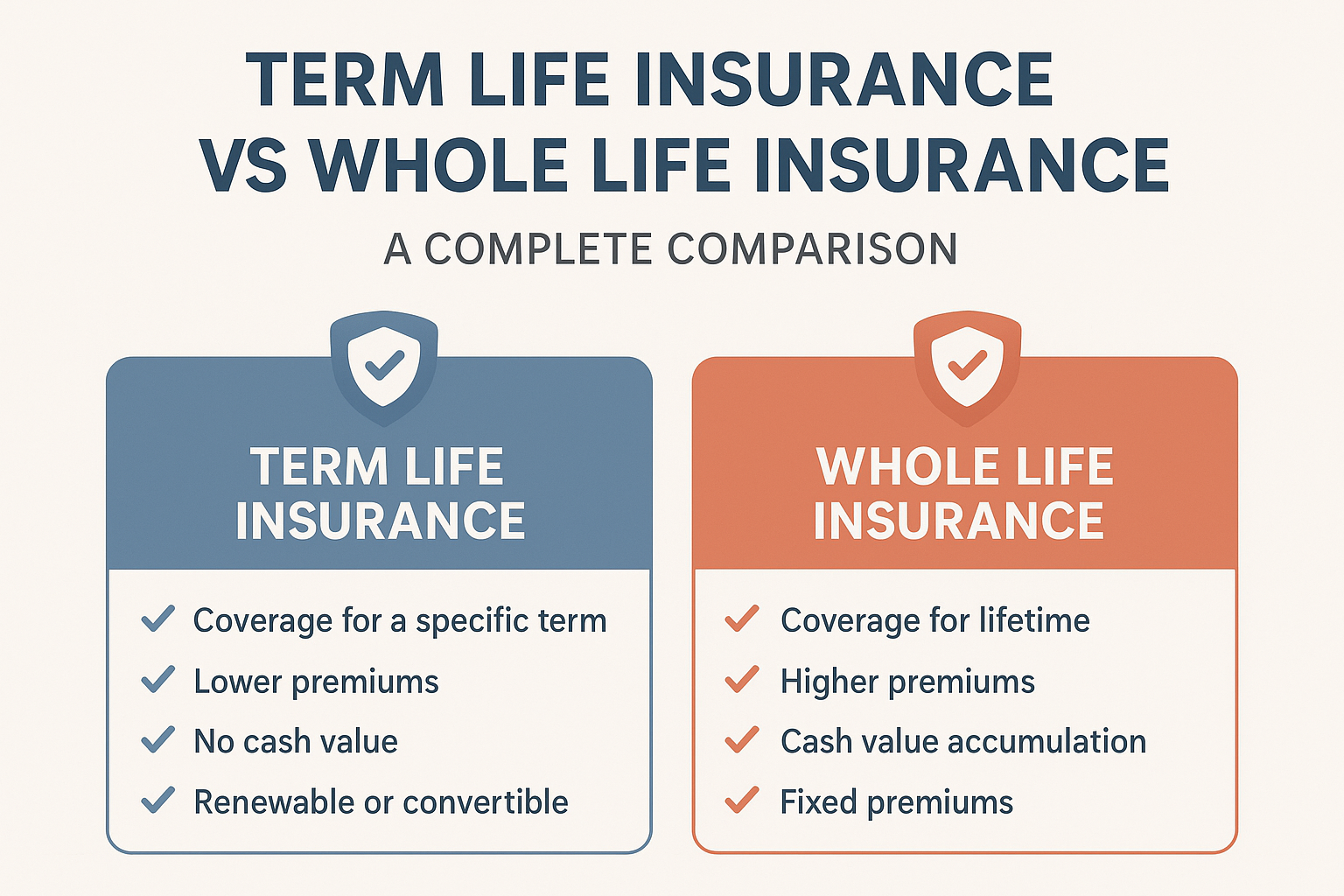

What Is Term Life Insurance?

Term life insurance provides coverage for a specific period (term), usually ranging from 10 to 30 years. If the policyholder dies during the coverage period, the insurer pays a death benefit to the beneficiary. If the policyholder survives the term, no payout is made (unless the plan includes a return of premium option).

Key Features of Term Life Insurance:

- Coverage for a fixed duration (10, 20, 30 years).

- Affordable premiums compared to whole life insurance.

- Provides only a death benefit—no cash value.

- Ideal for income replacement and family protection during working years.

What Is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime. Along with the death benefit, it also includes a cash value component that grows over time and can be borrowed against or withdrawn.

Key Features of Whole Life Insurance:

- Lifetime coverage—policy never expires as long as premiums are paid.

- Higher premiums compared to term life insurance.

- Builds cash value that grows tax-deferred.

- Can be used for estate planning, wealth transfer, and retirement funding.

Term Life vs Whole Life: Core Differences

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10–30 years) | Lifetime coverage |

| Premiums | Low and affordable | Higher, fixed premiums |

| Death Benefit | Yes, if death occurs within the term | Yes, guaranteed payout |

| Cash Value | None | Yes – grows over time |

| Purpose | Income replacement, family protection | Wealth building, estate planning, lifelong coverage |

| Cost (Average) | $25–$40/month for $500,000 coverage (age 30) | $200–$400/month for same coverage (age 30) |

| Flexibility | Simple, straightforward | Can be used as investment + protection |

Benefits of Term Life Insurance

- Affordability – Term life is the most cost-effective way to get high coverage at low premiums.

- Flexibility in Terms – Choose coverage based on major milestones (children’s education, mortgage, retirement).

- Pure Protection – Focused solely on financial protection for your family.

- Easy to Buy Online – Most insurers offer quick approval with minimal paperwork.

Benefits of Whole Life Insurance

- Lifetime Protection – Provides lifelong peace of mind for your loved ones.

- Cash Value Growth – Acts like a savings/investment plan along with insurance.

- Loan Options – You can borrow against the cash value for emergencies or retirement needs.

- Wealth Transfer & Estate Planning – Useful for high-net-worth individuals to leave a tax-efficient legacy.

- Fixed Premiums – Your premium stays the same for life, even as you age.

Cost Comparison: Term vs Whole Life

Term Life Insurance: A 30-year-old non-smoker can buy a $500,000 term life insurance policy for about $25–$30/month.

Whole Life Insurance: The same person would pay $200–$400/month for $500,000 coverage, depending on the insurer.

👉 Term life is 8–12 times cheaper than whole life insurance for the same coverage.

When Should You Choose Term Life Insurance?

Term life insurance is best suited for:

- Young families who want to protect dependents in case of unexpected death.

- Individuals with debts like mortgages, student loans, or personal loans.

- Budget-conscious buyers who need maximum coverage at low cost.

- Temporary needs like covering income during working years.

Example: John, 35, buys a 20-year term policy for $1 million at $40/month to cover his family until his children are grown and his mortgage is paid off.

When Should You Choose Whole Life Insurance?

Whole life insurance is ideal for:

- High-net-worth individuals focused on estate planning and wealth transfer.

- People looking for investment + insurance in one product.

- Parents wanting to leave a guaranteed inheritance.

- Those with lifelong dependents (e.g., special needs children).

Example: Sarah, 40, buys a whole life insurance policy of $250,000. Over time, her cash value grows, allowing her to borrow funds for retirement while still leaving her children a guaranteed payout.

Tax Benefits of Term and Whole Life Insurance

Term Life Insurance Tax Benefits:

- Premiums may be tax-deductible in some regions.

- Death benefits are usually tax-free for beneficiaries (IRS §101 in the U.S.).

Whole Life Insurance Tax Benefits:

- Cash value grows tax-deferred.

- Death benefits are tax-free.

- Policy loans are generally tax-free if managed properly.

Pros and Cons: Term vs Whole Life Insurance

Term Life Pros:

- ✔ Low premiums

- ✔ Simple and straightforward

- ✔ High coverage amount

Term Life Cons:

- ✘ No cash value

- ✘ Coverage ends after term

Whole Life Pros:

- ✔ Lifetime coverage

- ✔ Cash value growth + loan options

- ✔ Useful for wealth transfer

Whole Life Cons:

- ✘ Expensive premiums

- ✘ Less flexible if financial needs change

Can You Have Both Term and Whole Life Insurance?

Yes, many people choose a hybrid approach:

- Buy term life insurance for high, affordable coverage during working years.

- Buy a smaller whole life policy for lifetime coverage and wealth building.

This strategy balances affordability and lifelong security.

Tips for Choosing Between Term and Whole Life Insurance

- Assess Your Financial Goals – Do you want pure protection or protection + investment?

- Compare Quotes Online – Use tools to find the best life insurance companies with competitive rates.

- Check Claim Settlement Ratios – Ensure your insurer has a strong record of paying claims.

- Buy Young – Premiums are much lower when purchased at a younger age.

- Consider Riders – Add benefits like accidental death, critical illness, or waiver of premium.

Conclusion: Term Life vs Whole Life Insurance

Both term life insurance and whole life insurance provide valuable financial security, but they cater to different needs.

- Choose Term Life Insurance if you want affordable coverage for a fixed period to protect your family and cover debts.

- Choose Whole Life Insurance if you want lifetime coverage, cash value growth, and estate planning benefits.

👉 For many people, the best solution is to start with term life insurance (for immediate and affordable protection) and later add whole life insurance when income allows for long-term wealth planning.